Directors reflect the community they serve. You could play an integral role in shaping the future direction of your credit union.

Members working for Members

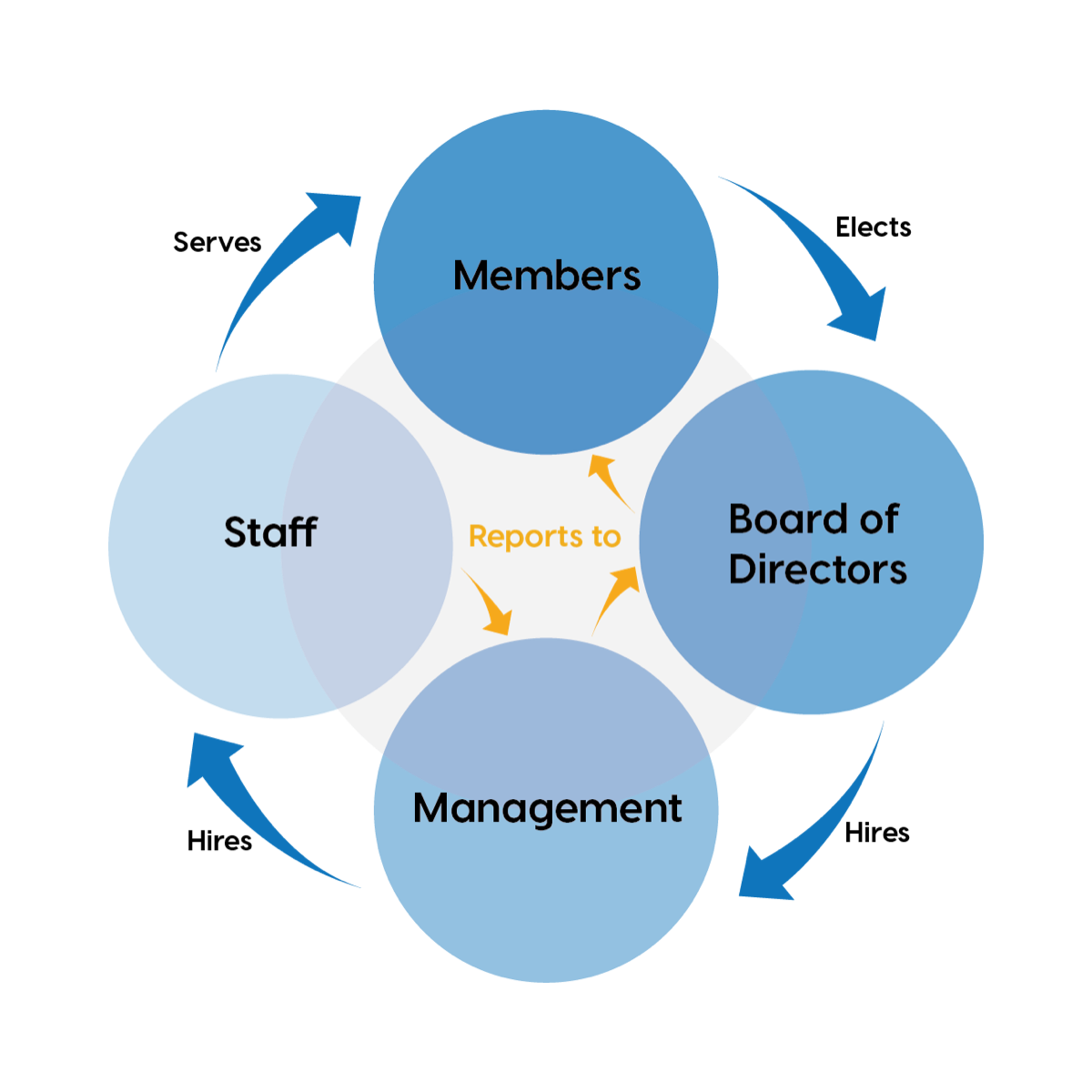

Credit unions are full service financial co-operatives. Our members are our owners. Rooted in this co-operative structure, the credit union difference is all about service – by members for members, right here in our community.

Make a difference in your community as a Director on the Board

Credit unions’ profits have a higher purpose – to benefit the people they were built to serve. Any extra profits leftover at the end of the year are returned to members in the form of dividends, or donated to communities in the form of donations, scholarships and other initiatives.

The Directors of a credit union represent the communities they serve. It is important for a credit union to have a strong board consisting of a diverse group of people.

If you share our belief that financial institutions best serve the people who use them and their communities, then you can make a real contribution; you can help your community thrive.

Make a difference in your credit union as a Director

As policy makers, Directors are instrumental in effecting positive changes within the credit union management. Directors provide a direct link and a fresh perspective helping their credit union be more responsive to member needs.

As a Director, you are accountable to the membership, for all policies and decisions at your credit union. You are also responsible to ensure sound management of the credit union and to safeguard the members’ assets.

Expand your everyday personal skills

Develop your networking circle and discover more about the financial world.

As a Director you will experience exceptional growth, and be able to use your new skills set in your everyday life.

Expand your skills with training As a Director, you will be given all the training and tools needed to succeed.

Designed for credit union Board of Directors, this unqiue learning program is a roadmap to the knowledge and skills required to effectively govern the credit union. Each level includes courses focused on different aspects of governance, specifically related to co-operative deposit-taking financial institutions.

To best serve your lifestyle, courses are offered as in-class or online sessions.

Nomination process

- Position(s) open on the Board of Directors

- Eligible members are nominated

- Members vote to elect the Director(s)

- The newly elected Director(s) begin their three year term on the board

Ready to join the Board?

Create a lasting impact on your community as a member of the Board of Directors.

The credit union would benefit from your energy and expertise!

Board of Directors Eligibility Requirements*:

A person who is a citizen of Canada, 18 years of age or older, a member/owner of the credit union, acts as an individual owner, not on behalf of a company/organization and who satisfies the requirements set out in the by-laws of the credit union may be a Director, unless he or she:

- is an employee of a credit union, credit union central or the Credit Union Deposit Insurance Corporation

- is a Director of another credit union

- is a professional advisor to a credit union

- has a loan more than six months in arrears

- has the status of bankrupt

- has been convicted within the previous five years of an offence related to the qualifications and duties of a Director, including but not limited to fraud

Does this sound like like you or someone you know? If so, visit your credit union to learn more about being on the Board of Directors.

*requirements vary per credit union